IN THIS LESSON

Build Your Empire: Business Credit and Funding Acceleration Plan

From Zero to $1M SBA in 2–5 Years

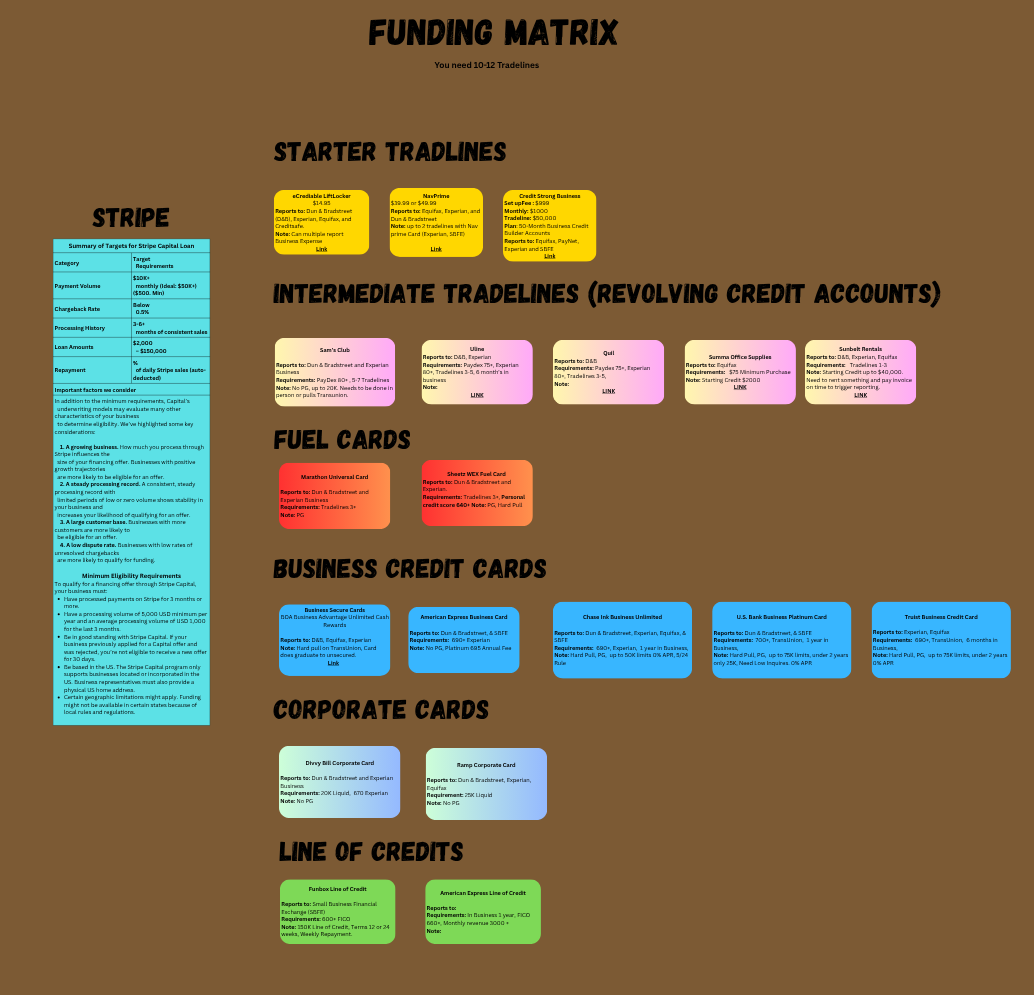

This plan is a structured roadmap for new corporations or early-stage businesses to build 10–12 tradelines, establish verified cash flow through Stripe, and scale toward $1M SBA approval without over-reliance on personal guarantees.

Strategic Goals

· 2-Year Goal: Secure $100K+ in combined lines and loans to qualify for a $1M SBA 7(a) loan with 10 percent down.

· 5-Year Goal: Build a portfolio to $1M+ revenue, leverage equity for larger SBA capacity up to $5M, target 20 to 30 percent ROI.

· Aggressive Variant: With strong credit and $8K to $12K monthly revenue, reach $200K secured funding in roughly 12 months.

Key Assumptions and Guardrails

· Starting Point: New C-Corp with EIN and DUNS filed. Personal FICO 650+ for early PG where required. $5K to $10K setup capital.

· Revenue Rule: Route at least $1K per week via Stripe using real clients or routed nonprofit funds. Keep invoices and emails as audit trail.

· Metrics: Track Paydex, Experian Business Score 75+, and Bank Rating High 4+ with average daily balance of $7K to $10K.

· Risk Control: Limit fuel cards to two. Pay off Credit Strong after 3 to 6 months to lock in a paid-in-full boost. If liquid cash exceeds $20K for 61 days, apply for Divvy or Ramp without PG.

SBA Red Flag Disclaimer: Routed nonprofit transfers must have verifiable business purpose (for genuine services). Consult a CPA; do not falsify invoice purpose, as SBA auditors scrutinize circular cash flows for fraud.

Credit Score Benchmarks

· Personal FICO thresholds: 650+ (starting PGs), 680+ (Chase Ink), 690+ (Amex Blue), 720+ (Truist).

· Business: PAYDEX 80–95 (Good–Excellent), Intelliscore 50–100 (Fair–Prime), FICO SBSS 165+ (SBA prescreen).

· Bank Rating tiers: Low 4 ($1K–$4K avg), High 4 ($7K avg), Low 5 ($25K avg), High 5 ($50K+ avg), Low 6 ($100K+ avg), High 6 ($500K+ avg).

Phase 1: Foundation (Months 0–3)

Focus: Establish the business profile without PG and create velocity in Stripe.

Goal: PAYDEX 50 to 70

Funding Target: $0 setup only

Phase 2: Acceleration (Months 4–6)

Focus: Use limited PG to add high-visibility lines.

Goal: PAYDEX 80+

Funding Target: $50K tradeline

Phase 4: Scale to SBA (Year 2)

Focus: Shift to revenue-based and no-PG options and prepare the SBA package.

Goal: PAYDEX 85 to 90

Funding Target: $250K cumulative funding

Phase 5: Empire Building (Years 3–5)

Focus: Use SBA for acquisitions and scale ROI.

Goal: 20 to 30 percent ROI

Funding Target: $1M+ SBA capacity

Compliance and Advisory Notes

Fuel Card Limit: Do not open more than two (2) fuel cards per corporation. Opening additional cards early can appear high-risk and negatively impact your business credit profile.

Stripe Capital Guidance: Businesses processing consistent B2B transactions through Stripe and maintaining at least $1,000 per month in verified payments typically receive a Stripe Capital loan offer after approximately seven (7) months of continuous activity.

-

Minimum eligibility requirements https://docs.stripe.com/capital/how-stripe-capital-works

-

How Important is a Business Bank Account Rating by Commerce Commercial Credit: Explains the rating system based on average balances (e.g., $10,000+ for a Low-5 rating) and why it's crucial for funding access.

Link: https://www.commercecommercialcredit.com/blog/how-important-is-a-business-bank-account-rating

-

4 Things Banks Want to Know About Your Business Bank Account by Nav: Covers what lenders review in your accounts, including healthy average daily balances to show stability for loans. Link: https://www.nav.com/blog/what-lenders-want-know-business-bank-account-16252/

-

Mastering Bank Ratings: A Guide to Enhance Your Business's Creditworthiness by Paul A. Damiano on LinkedIn: Breaks down the five-level rating scale and recommends $10,000+ averages for better funding odds. Link: https://www.linkedin.com/pulse/mastering-bank-ratings-guide-enhance-your-businesss-paul-a-damiano-rvgge